Outlook on the Japanese equity market

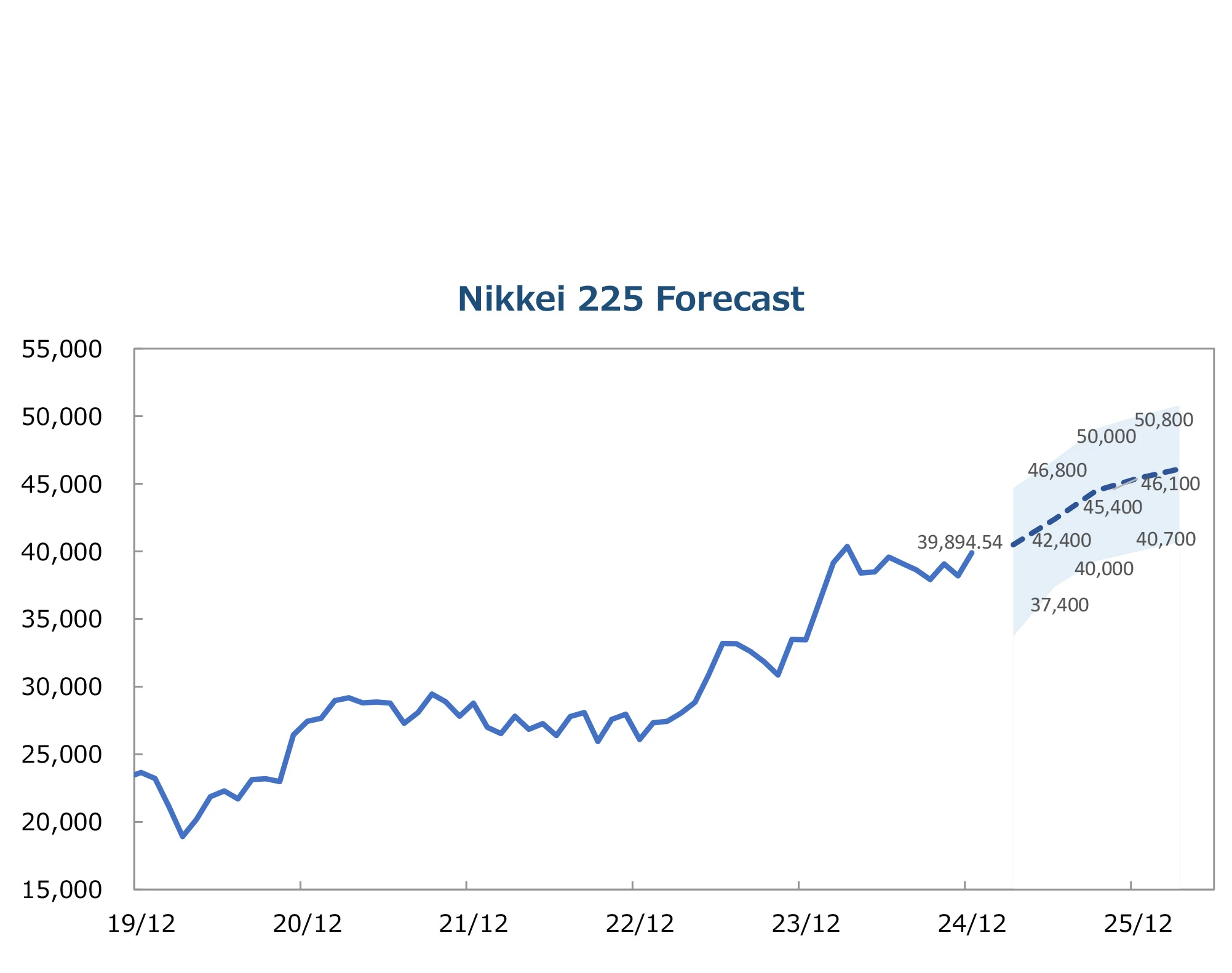

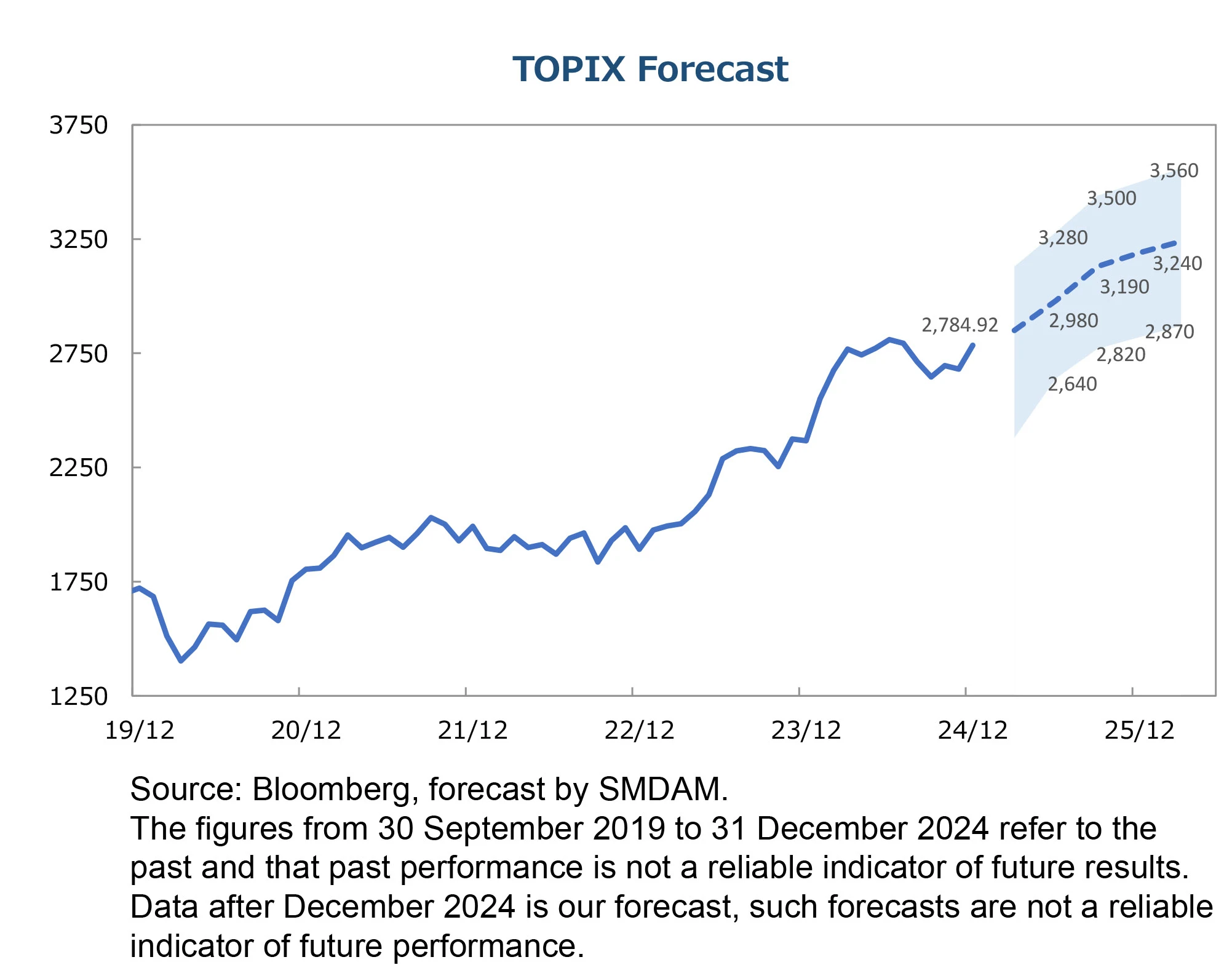

- We estimate the Nikkei 225 will surpass the 40,000 mark again in the near future and reach 45,000 by the end of CY 2025. *

- Further out we are bullish on the Japanese stock market over the mid-to-long term due to steady growth of corporate earnings, the virtuous cycle of “wage increase and mild inflation” and improvements in corporate governance.

- Range bound trading should break upward post the Trump inauguration.

- We have seen large levels of share buybacks (as much as 17 trillion

yen in FY 2024, equal to $108 bn - ) boosting investor returns.

Potential upsides risks

- An increase in GDP growth now deflation has ended

- Further improvements of corporate governance, driven by

the Tokyo Stock Exchange

Potential downside risks

- Tighter fiscal policy aimed at achieving a primary surplus

- Excessive and rapid appreciation of the yen, which could impact corporate earnings

- Stagnation in the manufacturing business cycle

Limited negative impact from overseas

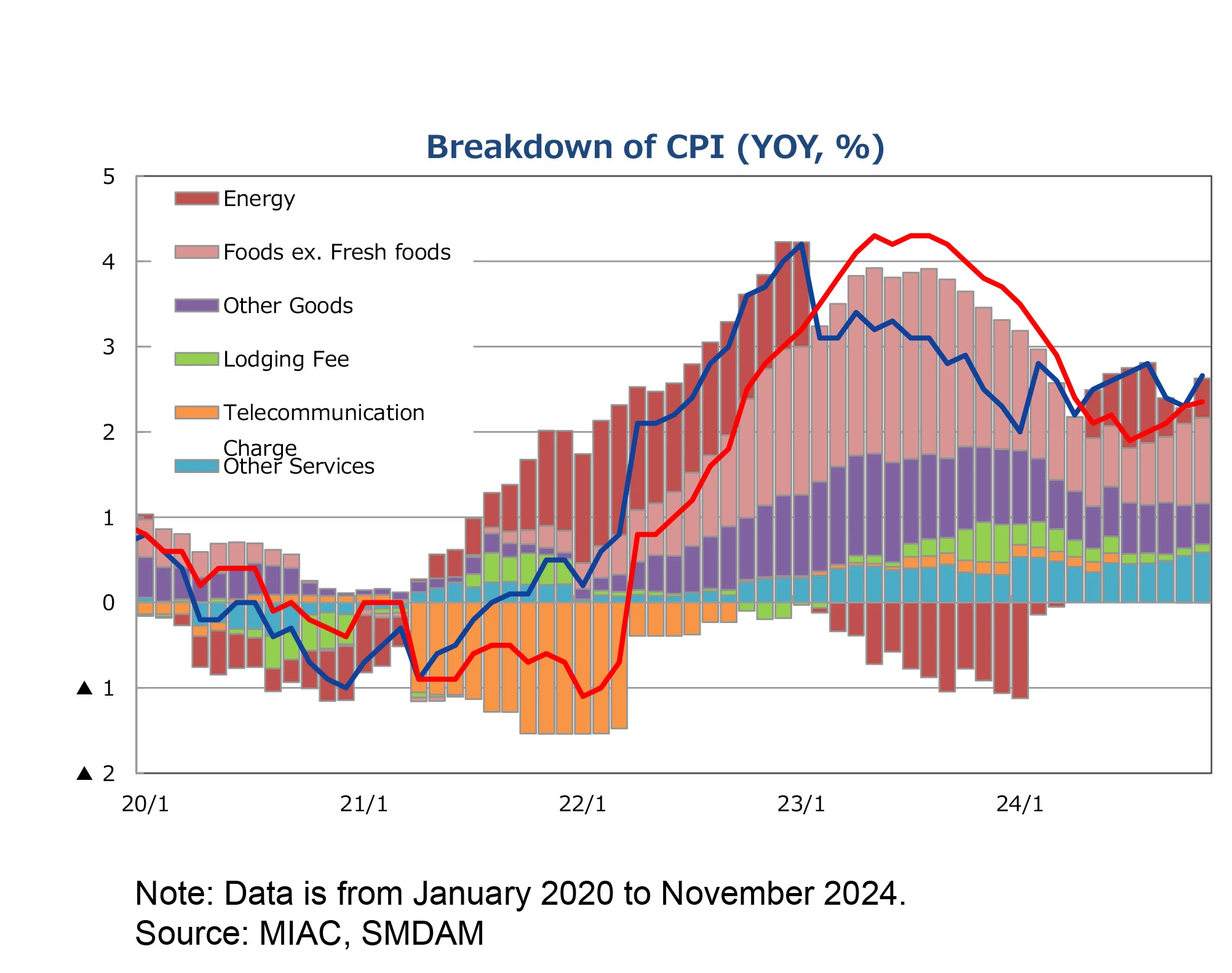

Core CPI for the nation rose by +2.3% YOY in October, down from +2.4% in September, while the Tokyo Metropolitan Area core CPI rose by +2.2% YOY in November, up from +1.8% in October. The rise in the Tokyo Metropolitan Area core CPI was mainly driven by energy prices, following the reduction of government emergency measures to cope with the extreme heat. Additionally, rising service prices and cost-push pressure from the depreciation of the JPY may have also contributed.

Core CPI projections adjusted only for 2026

While the core CPI forecast remains at +2.6% for FY 2024 and +2.1% for FY 2025, it has been lowered for FY 2026 from +1.9% to +1.5%. Cost-push pressure from import prices will decrease, but inflation will stabilise due to wage-driven service price increases. The BOJ Core CPI is forecast at around +2.0% YOY, excluding subsidies for utilities and petrol tax changes.

Real GDP growth forecasts revised upwards

We have raised the real GDP growth forecast for FY 2024 from +0.3% to +0.5% and for FY 2026 from +0.8% to +0.9%, maintaining FY 2025 at +1.2%.

The upward revision for FY 2024 reflects data from July-September 2024, while FY 2026 reflects the assumed elimination of the provisional gasoline tax. The increase in the minimum taxable income is expected in 2025, with a moderate growth path supported by wage increases, CAPEX appetite, economic measures, and resilient overseas economies.

Government plans fiscal measures for growth

The government is expected to adopt accommodative fiscal policies to combat deflation over the next three years. Prime Minister Ishiba confirmed a focus on sustainable growth. The Cabinet approved economic measures, including a tax cut agreement to raise the minimum taxable income to 1.78 million yen ($11.3k circa) in 2025 and eliminate the gasoline tax.

Bank of Japan - monetary policy unchanged

The forecast for BOJ monetary policy remains unchanged. We expect rate hikes to 0.50% in January 2025, 0.75% in July 2025, 1.00% in January 2026, and 1.25% in January 2027. BOJ will coordinate with the government before each rate hike, considering inflation and global conditions. Gradual hikes toward a neutral rate will proceed until 1%, with risks from Trump led US tariffs increasing. If the Japanese economy is impacted, the BOJ may delay further rate hikes.

If you would like to access the full report please contact your business development representative.

*Calculated by multiplying current and next fiscal year’s estimated EPS by 12 month forward price to earnings ratio. These forecasts represent our house view based on bottom up and top down analysis, rather than a simulation of past performance of the equity market.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM