Outlook on the Japanese equity market

- Japan has been a volatile market of late, driven by uncertainty around the US economy and Japan’s shift in monetary policy. However we believe there will be a bullish rally once the trajectory of US monetary

policy becomes clearer and market volatility stabilizes. - We believe that the US economy will avoid a hard landing, thanks largely to robust consumer spending. Additionally, we expect the Bank of Japan (BOJ) to adopt a more cautious approach, gradually raising its policy rate which will please the markets.

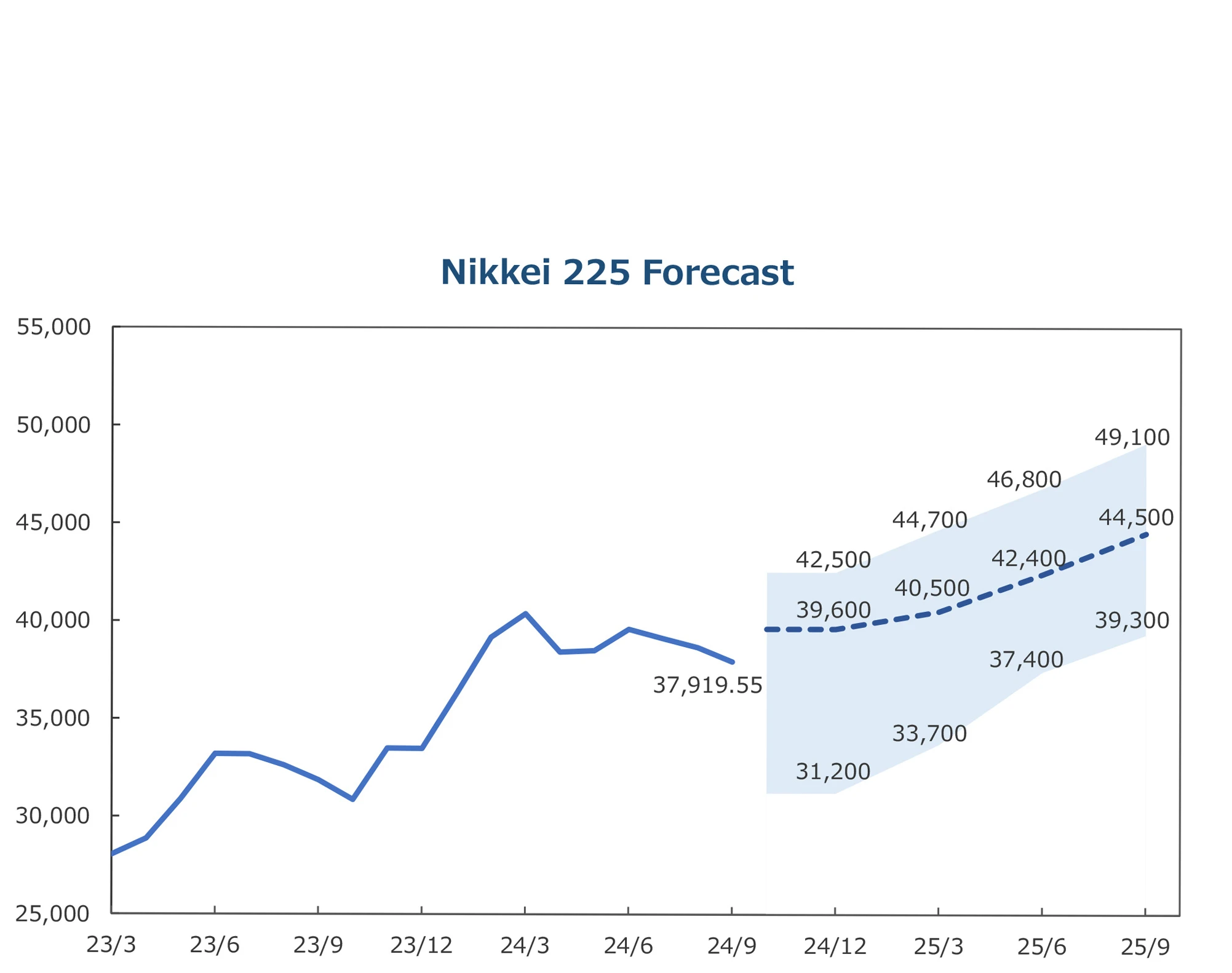

- By the end of March 2025, we project the Nikkei 225 will surpass the 40,000 mark and may well reach 45,000 by the end of the year.

- Although Shigeru Ishiba’s unexpected victory in the Liberal Democratic Party (LDP) leadership election initially disappointed markets, an early snap election during the “honeymoon period” for the new prime minister could bolster the ruling LDP’s approval ratings and positively impact the equity market in the near term.

Upside risks

- Receding excessive concern over the US economy

- Further improvement of corporate governance, led by Tokyo

Stock Exchange

Downside risks

- Tighter fiscal policy to target the primary surplus

- Hasty monetary tightening by the Bank of Japan

- FExcessive and rapid JPY appreciation

Consumer spending on the rise amidst steady data

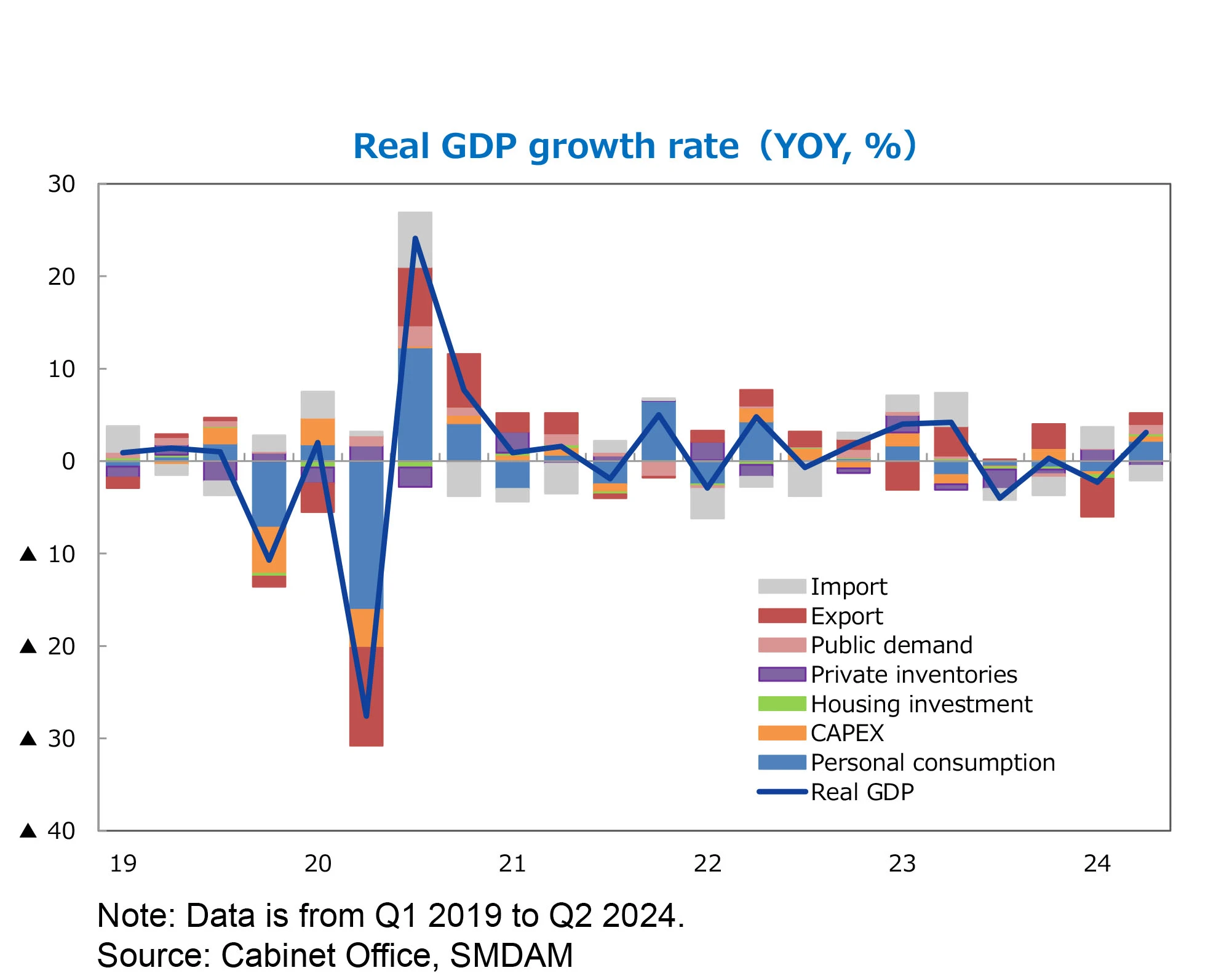

In the second quarter of 2024, real GDP grew for the first time in two quarters, marking a significant turnaround. Notably, consumer spending, which had been sluggish, increased for the first time in five quarters.

Despite fluctuations in stock prices and a strengthening yen,

soft data released earlier than hard data—has remained robust. The PMI (August) and the Economy Watchers Survey (August) showed recovery, while the Consumer Confidence Index (August) remained strong.

Furthermore, the CAPEX plans outlined in the Business Survey

Index for Q3 indicate solid growth expectations.

Inflation trends and economic outlook

Inflation has been on the rise, with the nationwide core Consumer Price Index (CPI) increasing by 2.7% year-over-year in July, up from 2.6% in June. In the Tokyo Metropolitan Area, the core CPI rose 2.4% year-over-year in August, accelerating from 2.2% the previous month.

The nationwide core CPI has been significantly impacted by the removal of subsidies for electricity and gas bills, while the depreciation of the yen has also contributed to the uptick in the Tokyo area.

Economy expected to return to moderate growth

We have slightly adjusted our real GDP growth forecast for fiscal year 2024, lowering it from 0.5% to 0.4%. However, our forecast for fiscal year 2025 remains unchanged at 0.7%. The revision for FY 2024 is primarily due to updated GDP figures for the second quarter of 2024.

Looking ahead, we expect the Japanese economy to regain a moderate growth trajectory. This will be supported by wage increases and robust capital expenditure driven by laboursaving initiatives, digitalization, greening projects, urban development, and semiconductor factory construction. Global economies are demonstrating resilience which will also aid the Japanese economy.

Our core CPI forecast for FY 2024 remains at 2.5%, but we have revised our FY 2025 forecast down to 2.0% from 2.2%. This adjustment is mainly due to changes in our assumptions regarding crude oil prices and foreign exchange rates. We have lowered our WTI price forecast to $70 per barrel from $75, and we now expect the dollar-yen exchange rate to average 148

yen in FY 2024 (down from 151 yen) and 141 yen in FY 2025 (down from 145 yen).

We anticipate that the nationwide core CPI will remain above 2% throughout 2025. While cost-push pressures from import prices are expected to ease, the end of subsidies for electricity, gas, and petrol will likely drive energy prices higher. Additionally, service price increases are expected to coincide with wage hikes. From 2026 onward, while energy factors may stabilize, core CPI is likely to remain steady at around 2% year over-year due to ongoing increases in service prices.

Expectations for policy continuity under new

leadership

We anticipate that the government will continue its accommodative fiscal policy. Prime Minister Kishida has announced plans for economic measures to be implemented this autumn.

Despite his decision to step down, his successor, Mr. Ishiba, is expected to maintain existing fiscal policies, including plans to extend subsidies for electricity, gas, and gasoline for low-income households.

Revised monetary policy forecast

We have adjusted our forecast for the Bank of Japan’s monetary policy as follows: we now expect the policy rate to rise to 0.50% in December 2024, 0.75% in July 2025, and 1.00% in January 2026 (previously projected as 0.50% in January 2025, 0.75% in July 2025, and 1.00% in January 2026).

The decision to bring forward the timing of the next rate hike by one month is based on (1) the limited adverse impact of financial market instability on the economy since August and (2) the Policy Board members’ consistent intention to maintain a hawkish stance while closely monitoring financial market developments. The timing of subsequent rate hikes remains unchanged.

If you would like to access the full report please contact your business development representative.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM

General Disclaimer:This material is issued and distributed by Sumitomo Mitsui DS Asset Management (Hong Kong) Limited (“SMDAM(HK)”) exclusively intended for “Professional Investors” (as defined in the Securities and Futures Ordinance (Cap. 571) and/or the Securities and Futures (Professional Investors) Rules (Cap.571D) under the laws of Hong Kong) for informational purposes only, and is not intended for distribution to the general public. It is recommended that you seek the advice of a professional financial or legal advisor to assist in due diligence and determine the appropriateness and consequences of being treated as a Professional Investor. This material has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any other regulatory authority. The information contained in this material has been obtained from sources that are deemed to be reliable and is made available solely for informational purposes. SMDAM(HK) makes no representations or warranties as to the information and does not guarantee its accuracy, timeliness, completeness or usefulness. You are advised to exercise caution in relation to this material, and if you are in any doubt about the contents of this material, it is recommended that you should seek the advice of an independent professional. This material and the information it contains are strictly confidential, the property of SMDAM(HK), and are intended exclusively for the intended recipients. The written consent of SMDAM(HK) is required before it can be replicated or distributed to third parties or used for any other purpose, except as required by law or regulatory requirements. It is not intended for distribution or use by any individual or entity in any jurisdiction or country where such distribution or use would be in violation of local law or regulation. SMDAM(HK) and its affiliated entities accept no liability whatsoever for any consequences, whether direct or indirect that may arise from any third party’s use of information contained in this material. This material is not intended to serve as an invitation, offer, solicitation or recommendation for any investment strategy or the purchase or sale of securities, including shares or units of funds. Any views, analyses, perspectives expressed, and references to companies should not be construed as recommendations or endorsements by SMDAM(HK). All comments, opinions, data and forecasts in this material are based on the information available at the time of drafting, and are subject to change without prior notice in response to market and other conditions. The information provided does not constitute investment advice and should not be relied upon as such. This material may contain certain statements that may be deemed to be forward-looking statements. Please note that any such statements are not guarantees of future performance and actual results or developments may differ significantly from those projected. No assurance can be given that the investment objective of any investment products will be achieved. No representation or promise as to the performance of any investment products or the return on an investment is made. This material does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may access or receive this material. Investment involves risk, including the possible loss of principal amount invested. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets are not indicative of future performance. Any investment decisions made by investors should not be solely based on this marketing material. Investors should refer to the fund’s offering document in order to fully understand the associated risk factors. The value of an investment may go down or up. The final decision in relation to any investment in any stock, companies or markets referred to in this material should be made by you. If investment returns are not denominated in HKD or USD, US/HK dollar-based investors will be exposed to exchange rate fluctuations. The contents of this material are protected by copyright. Without SMDAM(HK)’s prior written consent, copying, reproduction or distribution of its contents in a hard copy and/or through the internet is strictly prohibited. Where the contents of this material have been translated into any language other than English and there is any inconsistency or ambiguity between the English version and the other version, the English version shall prevail. The above policies are subject to review and amendments by us from time to time. |

General Disclaimer:This material is issued by Sumitomo Mitsui DS Asset Management (Hong Kong) Limited (“SMDAM(HK)”) for informational purposes only and has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any other regulatory authority. Persons who access or receive this material should determine whether it is permissible to access or receive it in the relevant jurisdiction without violating any applicable laws and regulations. The material may contain information related to funds which are authorized by the SFC that are available for public sale in Hong Kong. However, SFC authorization is not a recommendation or endorsement of the fund, nor does it guarantee the commercial merits of the fund or its performance. It does not mean the fund is suitable for all investors, nor is it an endorsement of its suitability for any particular investor or class of investors. The information contained in this material has been obtained from sources that are deemed to be reliable and is made available solely for informational purposes. SMDAM(HK) makes no representations or warranties as to the information and does not guarantee its accuracy, timeliness, completeness or usefulness. You are advised to exercise caution in relation to this material, and if you are in any doubt about the contents of this material, it is recommended that you should seek the advice of an independent professional. The written consent of SMDAM(HK) is required before it can be replicated or distributed to third parties or used for any other purpose, except as required by law or regulatory requirements. SMDAM(HK) and its affiliated entities accept no liability whatsoever for any consequences, whether direct or indirect that may arise from any third party’s use of information contained in this material. This material is not intended to serve as an invitation, offer, solicitation or recommendation for any investment strategy or the purchase or sale of securities, including shares or units of funds. Any views, analyses, perspectives expressed, and references to companies should not be construed as recommendations or endorsements by SMDAM(HK). All comments, opinions, data and forecasts in this material are based on the information available at the time of drafting, and are subject to change without prior notice in response to market and other conditions. The information provided does not constitute investment advice and should not be relied upon as such. This material may contain certain statements that may be deemed to be forward-looking statements. Please note that any such statements are not guarantees of future performance and actual results or developments may differ significantly from those projected. No assurance can be given that the investment objective of any investment products will be achieved. No representation or promise as to the performance of any investment products or the return on an investment is made. This material does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may access or receive this material. Investment involves risk, including the possible loss of principal amount invested. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets are not indicative of future performance. Any investment decisions made by investors should not be solely based on this marketing material. Investors should refer to the fund’s Offering Documents, including the Product Key Facts Statement, in order to fully understand the associated risk factors. The value of an investment may go down or up. The final decision in relation to any investment in any stock, companies or markets referred to in this material should be made by you. If investment returns are not denominated in HKD or USD, US/HK dollar-based investors will be exposed to exchange rate fluctuations. The contents of this material are protected by copyright. Without SMDAM(HK)’s prior written consent, copying, reproduction or distribution of its contents in a hard copy and/or through the internet is strictly prohibited. Where the contents of this material have been translated into any language other than English and there is any inconsistency or ambiguity between the English version and the other version, the English version shall prevail. The above policies are subject to review and amendments by us from time to time. IMPORTANT: Please read this disclaimer carefully. By accepting this presentation, you acknowledge that you have read, understood, and agreed to be bound by the terms and conditions set forth herein. |