Many readers will already be familiar with the well-known quote from Hemmingway where one character asks another, ‘How did you go bankrupt?’ and receives the answer, ‘Two ways: gradually, then suddenly’.

The quote is perhaps better remembered than the novel it is extracted from because it seems to capture the paradox of change; small signals build up slowly, and then one day the process accelerates and the direction of travel appears with hindsight to have been obvious for some time.

Is the case for investing in Japanese equities today at a similar point?

Have the past few years – and even the entire decades since the bubble of the late 1980’s burst – seen the gradual accumulation of conditions favourable to Japan that could now suddenly galvanise this deep, rich market again? This article summarises the arguments recently presented by Alex Hart, Product Specialist at SMDAM, and Joe Bauernfreund, Fund Manager at Asset Value Investors, at a symposium hosted by SMDAM.

The traditional case for Japan

A series of factors have been lined-up in favour of the Japanese market for several years now. Both speakers emphasised this case in their presentations and highlighted the key features below:

1 - Under-valued

The Japanese market has tended to trade on very low valuations relative to other developed markets since the 1990s.

As Warren Buffet famously claimed in one of his much-quoted Chairman’s Letters, the starting price you pay for an investment will ultimately determine the investment performance, and accordingly we believe investors should pay attention to relative cheapness.

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”

In terms of forward PE ratios, US equity valuations have recently come down to the 18.1x level from the heightened 20x’s levels seen previously. Meanwhile the Japanese market is languishing at 13.2x according to Bloomberg as at 14 March 2025. This would traditionally be seen as deep value territory, and it is important to point out that analyst EPS revisions are still in an upward trend suggesting the picture is in fact changing on the valuations front.

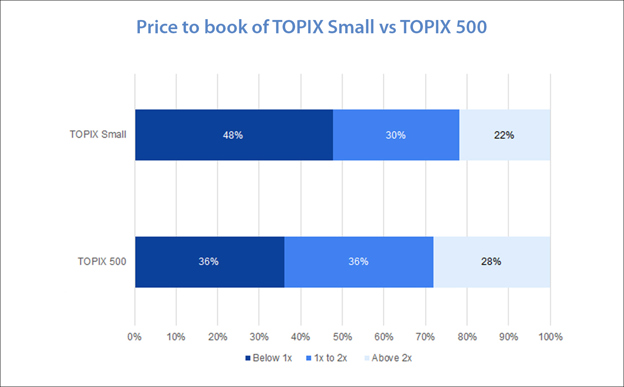

Going a little bit deeper, in terms of the wider TOPIX index, close to 50% of companies trade at below 1x price to book. This was a consequence of the collapse in asset values seen in the early 1990s and was further reinforced by the ‘cash hoarding’ behaviour of Japanese corporates that became endemic in the years that followed.

However, low valuations alone don’t make for a solid investment case. Whilst the Japanese market might previously have been seen as a potential value trap, as we explore further below there are now reasons to believe valuations are set to rise and that the market as a whole is now primed for the rebirth of its long-extinct dynamism.

2 - Under-researched

In combination with the high variety of companies trading at objectively low valuations, both speakers drew attention to the relative lack of research coverage.

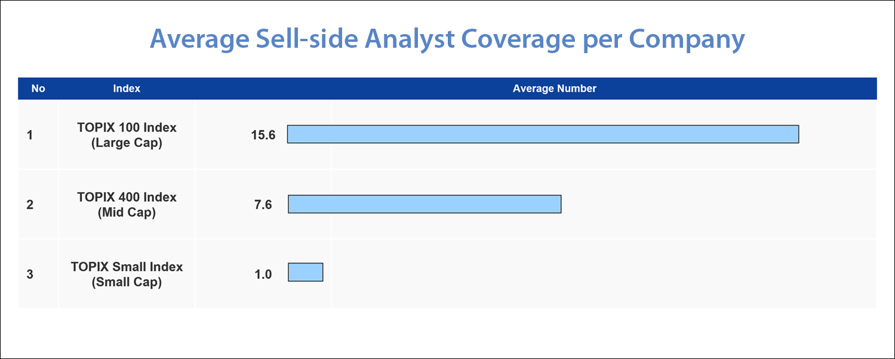

According to Bloomberg as at 14 March 2025, the largest 100 companies in the S&P500 by market cap have on average 36 analysts covering them. Against this benchmark, even Japanese large-cap stocks included in the TOPIX 100 could be termed as ‘under-researched’. As the chart below shows, the average number of analysts covering the 100 largest Japanese companies is less than half that dedicated to covering their US counterparts.

As such, although as shown in the chart below this trend is more pronounced in the SMID cap space, this phenomenon is also at play in the large cap space and creates myriad opportunities for active management.

3 - Large and diverse investable universe

Lastly, with a listed universe of nearly 4,000 companies, Japan boasts a total investable universe significantly larger than almost all other developed markets. This effectively creates an ideal playing field for stock-picking, with indices and the passive approach failing to capture the opportunities presented by the high dispersion of returns across this deep, rich market.

Have the catalysts finally arrived?

Tenured observers of the Japanese market might not find the above case new or surprising. Indeed, the factors above have to varying degrees been present over the past decade.

What is new is that a triumvirate of catalysts have recently emerged that suggest the low valuations are set to be corrected and that an active approach can effectively capitalise on this.

1 - Corporate reforms

Launched in March 2023, the Tokyo Stock Exchange’s reforms to corporate governance now have the momentum and wide-spread acceptance required to bear fruit.

With companies across the market cap spectrum being proactively encouraged to introduce measures to raise P/B ratio, return excess cash to shareholders, increase CAPEX, and reduce crossholdings, a new atmosphere of efficiency and dynamism is returning to the market.

Championed by Tokyo Stock Exchange CEO Yamaji, SMDAM’s view is that this agenda has now put Japanese corporates onto an irreversible path towards converging with the norms of good corporate governance already embedded and priced in to other developed markets. The time is ripe for investors to capitalise on this trend, and both presenters outlined why they see this as a fundamental shift of gear in the outlook for Japanese equities.

2 - New generation of managers

Secondly, as we have covered in another recent article, Why is a fresh look at Japan today essential? , the decades that have passed since the bubble deflated in the early 1990s have proved sufficient to usher in a new generation of corporate leaders. This new generation is more willing to accept shareholder activism than their predecessors, and likewise much more open to the efficiency enhancing reforms that have previously been resisted. This provides an ideal entry-point for new investors who can take advantage of this ‘changing of the guard’ which could see valuations start to equalise between Japanese and comparable companies in other developed markets

3 - Deflation finally over

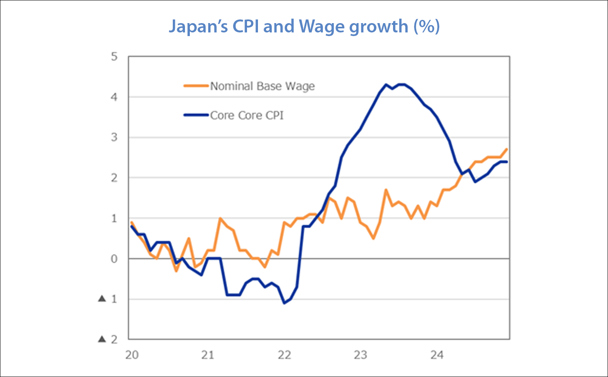

Finally on the macro side, the long-awaited virtuous cycle of rising wages and moderate inflation which would be needed to complete the ‘normalisation’ of the Japanese economy does seem to be gathering pace. As can be seen in the chart below, wage increases and core CPI have now established a consistent upwards trend, and SMDAM’s economists expect this to continue looking ahead.

If the hypothesis that Japan has at last escaped the deflationary trap that blighted the past two decades is correct, then it really is time for allocators to take a fresh look at this under-appreciated market.

Why should investors consider going active in Japan?

Drawing it all together, both speakers advocated that the scenario sketched above necessitates an active stance. With Japanese market indices containing comparatively large numbers of constituents, and with a high rate of dispersion expected between the winners and losers from this new environment, fundamental-driven, bottom-up stock picking seemed to both presenters to be the most appropriate method to play the market today. The positive factors discussed above will continue to play-out at varying rates across sectors and in terms of individual companies, and both speakers argued stock selection to be the essential means of generating alpha.

Gradually, and then suddenly, Japan is today enjoying all the pre-conditions to welcome in a new era of investing.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM