We are all familiar with the conceptual distinction between ‘signal’ and ‘noise’. While philosophers of science can no doubt debate the finer points of this dichotomy indefinitely, for our purposes here it is enough to paraphrase statistician Nate Silver:

“The signal is the truth. The noise is what distracts us from the truth.”

In terms of financial markets, this distinction may often be easier to discern with the benefit of hindsight than it is in real time. However, as economists, we remain committed to the notion that actionable insights can be extracted from the welter of deluge of data if some effort is exerted towards separating what really matters (‘signal’) as opposed to what may be transitory or less significant (‘noise’).

Has the market missed a strong signal?

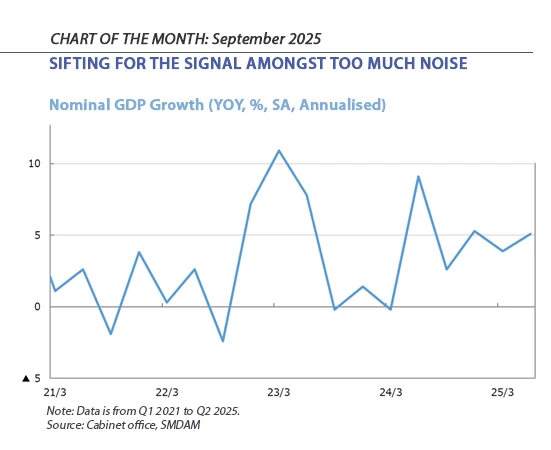

This month, we focus on a highly significant but underappreciated data point behind the recent rally in the Japanese stock market – the robust upward trend in Japanese nominal GDP. As the chart below underlines, controlling for expected volatility the momentum behind this trend has built considerably over the past 12 months.

Importantly, this has happened despite the seismic uncertainty unleashed by President Trump’s upheaval of U.S. trade policy, demonstrating a new-found resilience in the Japanese recovery that should be highlighted.

What’s the context that makes this signal so important?

For decades, Japan’s economy had been mired in deflation, a persistent drag on growth and sentiment. Yet since the spring of 2022, a mild but sustained inflationary trend has taken hold. At the time, this signal was easily lost in the surrounding noise. However, now in its fourth year, this inflationary trend has defied expectations and become entrenched in both consumer and producer expectations. Consumer prices are now rising at an annual pace exceeding 3%, despite a recent easing in energy costs and import prices.

Underneath this return of sustained inflationary pressure is an equally significant shift; whereas it was initially goods prices that drove this national inflation figure, now the brunt of the price rises are seen by the services sector. This transition is recasting inflation expectations across households and businesses, and with this comes meaningful changes to choices and economic behaviour. When consumers anticipate higher prices tomorrow, they are more inclined to spend today–which serves to put further upward pressure on prices and provides a bullish signal to producers.

At the same time, predictable inflation also incentivizes individuals to make sure that what they don’t consume, they invest so that their wealth has at least the potential to increase over time and keep pace with inflation. Meanwhile, firms sensing future cost increases are prompted to expand their capex pre-emptively and to explore productivity-enhancing innovations. Today, we are seeing strong evidence that these behavioural changes are not only occurring but are becoming normalized, and this suggests a deeper transformation in Japan’s economic psyche is underway.

Why focus on nominal GDP?

We believe this shift is most clearly reflected in the trajectory of Japan’s nominal GDP. Between 2012 and 2021, Japan’s nominal GDP grew at a modest average annualized rate of 1.3%. Over the past year, however, that figure has surged to 4.2%, with the most recent quarter (April–June 2025) registering a striking 6.6% increase.

Unlike real GDP, which adjusts for inflation, nominal GDP is more closely tied to the realities of fiscal revenues and corporate earnings. As both inflation and growth to some extent fed off each other and have become further entrenched, nominal GDP has shown a clear upward trend since spring 2024. This has translated into robust corporate performance, providing a solid fundamental underpinning for Japan’s buoyant equity markets.

Japan is currently navigating a path toward monetary normalisation. However, uncertainties—such as the impact of U.S. tariffs—have led the Bank of Japan to adopt a cautious stance, avoiding aggressive rate hikes. Meanwhile, real interest rates remain deeply negative, a consequence of low nominal rates and persistent inflation. This environment continues to exert powerful reflationary pressure on the economy.

In sum, Japan’s nominal GDP is poised for continued expansion, offering a compelling narrative for investors and policymakers alike. As inflation expectations evolve and economic behaviour adjusts, Japan may be entering a new era—one where growth is not only real, but also richly nominal.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM