Outlook on the Japanese equity market

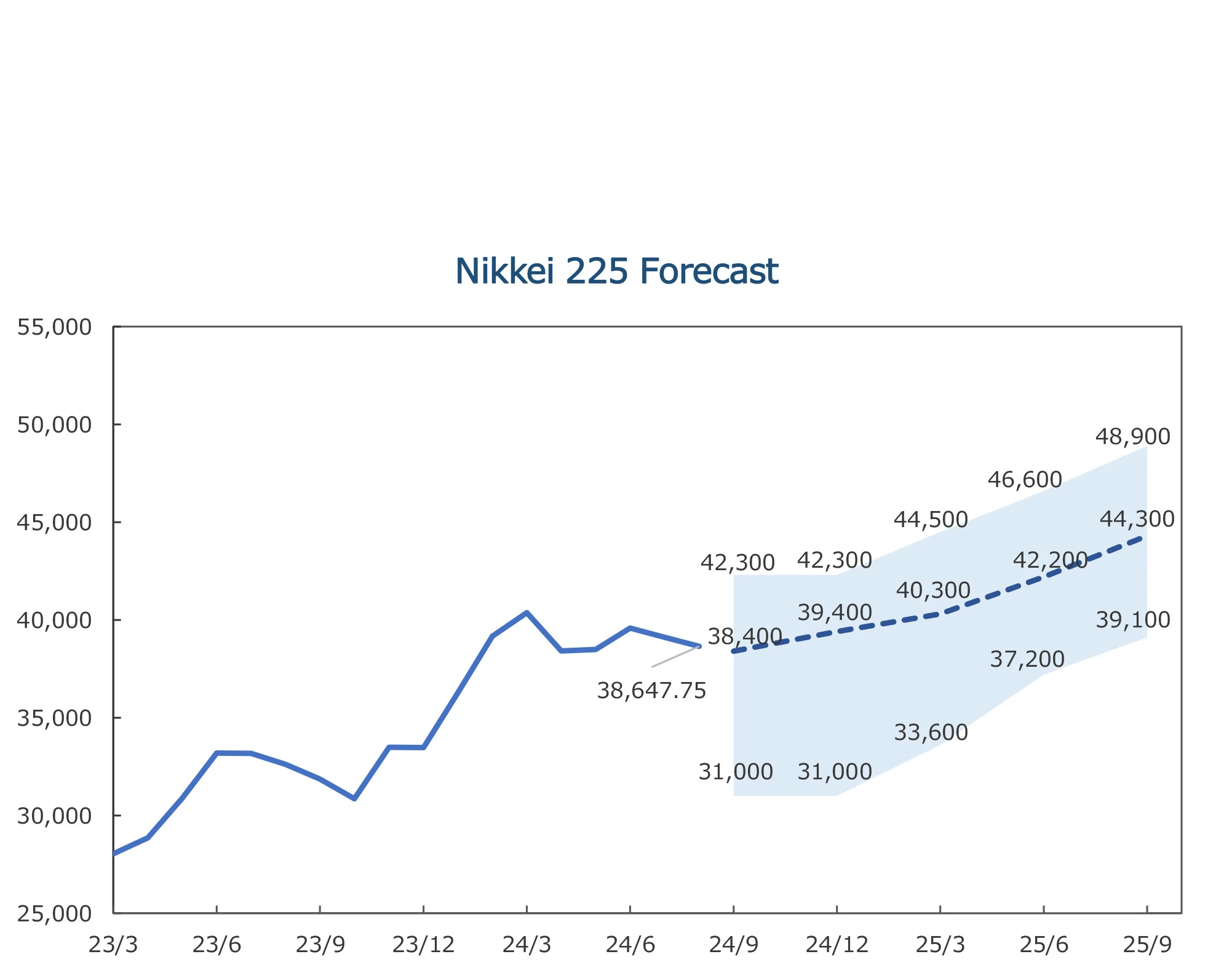

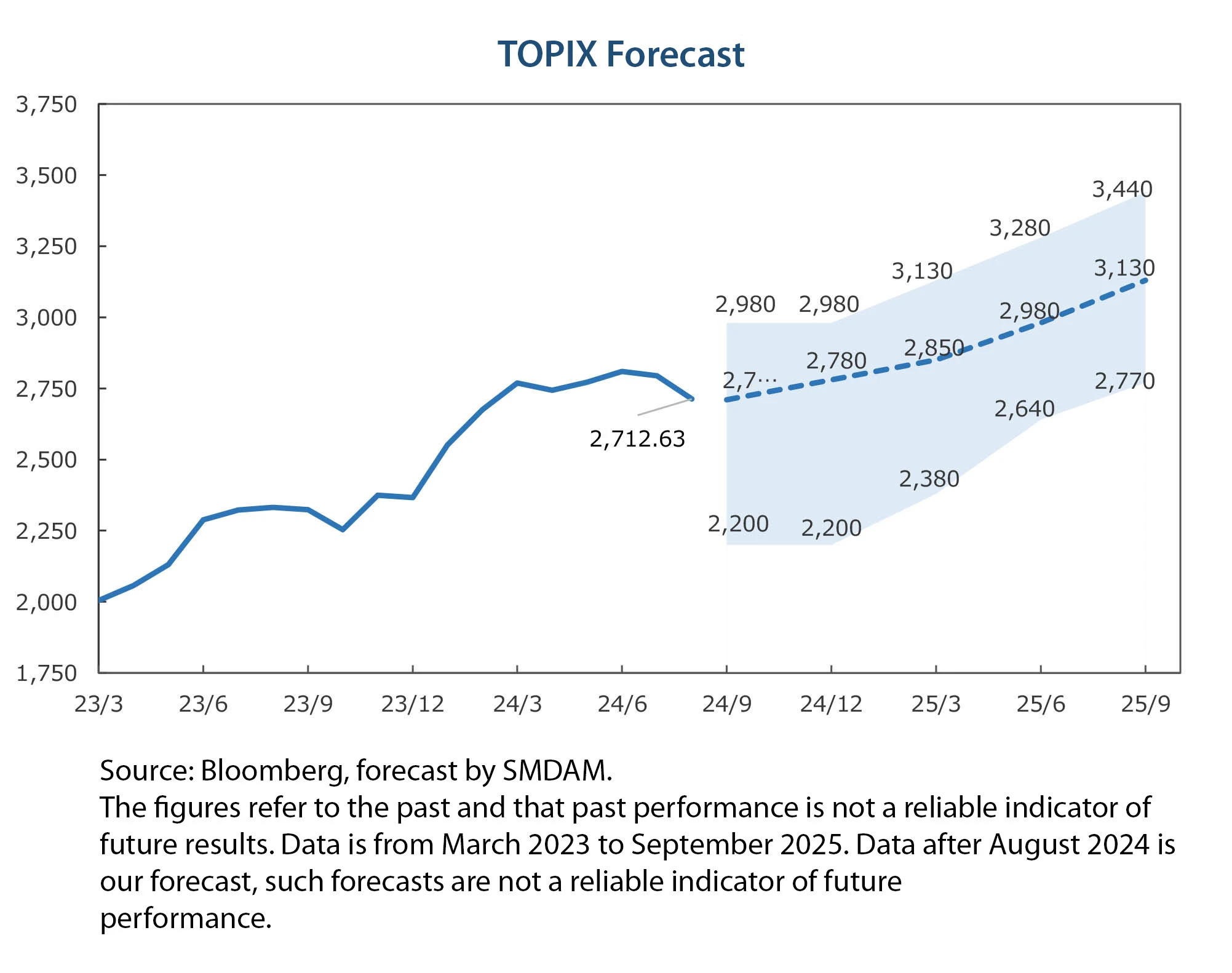

- We expect the Japanese equity market to resume its bullish trend after temporary correction caused by uncertainty in the US economy and concern over the hawkish stance of the Bank of Japan.

- We believe the US economy will avoid a “hard landing” thanks to the rate cut by the Federal Reserve, and the Bank of Japan (BOJ) will tone down its hawkish stance due to the recent sharp retreat of the USD/JPY rate.

- We have lowered our price target for the Nikkei 225 for FY 2024 to 40,300 from 43,000 and that for TOPIX to 2,850 from 3,050, due to a change in estimate P/E ratio after the recent spike in

market volatility.

Upside risks

The upside risk scenario includes the waning of excessive concern over the

US economy, alongside continuing improvements in corporate governance

and shareholders’ value led by the Tokyo Stock Exchange. On the other hand, the tightening of fiscal policy to achieve a surplus of primary balance, an excessive and rapid appreciation of the yen and hasty tightening of the monetary policy by the BOJ form the downside scenario.

Downside risks

In the second quarter of 2024, real GDP grew for the first time in two quarters. In particular, consumer spending recovered, growing for the first time in 5 quarters, due to the normalisation of auto production and an improvement in wages.

As for soft data, the Economy Watchers Survey and Consumer Confidence Index for July have been adversely affected by higher inflation, while the PMI recovered in July. Despite concerns about a slowdown in the U.S. economy and the impact of sudden changes in financial markets, there were no significant changes observed in the Reuters Tankan in August.

Nationwide core CPI rose +2.6% YOY in June, rebounding from +2.5% in May. Tokyo Metropolitan Area Core CPI rose +2.2% YOY in July, re-accelerating from +2.1% last month. Inflation was pushed up by energy prices as the policy factor of reduced levies for electricity and gas bills had a large impact.

Q2 lead to upward revision of real GDP growth forecast

We have raised our real GDP growth forecast for FY 2024 to +0.5% from +0.2%, and that for FY 2025 to +0.7% from +0.6%. Figures for FY 2024 have been revised upward due to strong results in Q2 2024.

As for the outlook, we expect the Japanese economy to return to a moderate growth path on the back of wage increases, fiscal stimulus, such as tax cuts and benefits, firm capital investment motivation, such as labour saving, digitalisation, greening, urban development, and construction of semiconductor factories, and the resilience of overseas economies.

In FY 2024, the effects of these two measures will mostly offset each other, but in FY 2025, both measures will lift our inflation forecasts. The nationwide core CPI is likely to be +2% by the end of 2025, given the energy boost from the end of subsidies for utility bills and gasoline. Thereafter, core CPI is likely to decelerate again due to the receding energy factor, and core CPI is expected to remain stable at around +2% YOY from around H2 of CY 2025, supported by the rise in service prices accompanied by wage hikes.

We have maintained our core CPI forecast for FY 2024 at +2.5% and that for FY 2025 at +2.2%. As for the outlook, the nationwide core CPI is likely to be above +2% level throughout 2025, given the energy boost from the end of utility bill subsidies and the gasoline subsidy. Thereafter, core CPI is likely to slow down due to the receding energy factor, and core CPI is expected to remain stable at around +2% YOY, supported by the rise in service prices accompanied by wage hikes.

Economic measures set soon after new prime minister

Prime Minister Kishida announced plans to implement various economic measures in autumn. In addition to providing subsidies to low-income households, the government will provide local subsidies to small and medium-sized companies, school lunches, medical and nursing care, logistics and regional tourism. Although the details of the economic measures have become less clear since Kishida announced that he will not run for leader of the Liberal Democratic Party, it is highly likely that the economic measures will be handed over to the next leader and prime minister. In view of the possibility of a dissolution of the Diet and a general election, we will pay close attention to the risk of large-scale economic measures.

Revised forecast for policy rates

The new forecasts of policy rates are 0.50% in January 2025, 0.75% in July 2025 and 1.00% in January 2026 (previously 0.50% in December 2024, 0.75% in June 2025, and 1.00% in December 2025). The main reason for our revision is the recent turnaround of USD/JPY rate, which reduces inflation risk and allows the BOJ to take time to assess various data before an additional rate hike.

The BOJ is expected to maintain its policy stance, and will focus on downside risks to the economy for a while. If the yen weakens sharply again or downside risks to the economy subside quickly, we cannot rule out the possibility of an additional rate hike by the end of the year. However, the main scenario is that an additional rate hike will be implemented after the central bank conducts a comprehensive review of the economy in the January 2025 Outlook Report.

If you would like to access the full report please contact your business development representative

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM

General Disclaimer:This material is issued and distributed by Sumitomo Mitsui DS Asset Management (Hong Kong) Limited (“SMDAM(HK)”) exclusively intended for “Professional Investors” (as defined in the Securities and Futures Ordinance (Cap. 571) and/or the Securities and Futures (Professional Investors) Rules (Cap.571D) under the laws of Hong Kong) for informational purposes only, and is not intended for distribution to the general public. It is recommended that you seek the advice of a professional financial or legal advisor to assist in due diligence and determine the appropriateness and consequences of being treated as a Professional Investor. This material has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any other regulatory authority. The information contained in this material has been obtained from sources that are deemed to be reliable and is made available solely for informational purposes. SMDAM(HK) makes no representations or warranties as to the information and does not guarantee its accuracy, timeliness, completeness or usefulness. You are advised to exercise caution in relation to this material, and if you are in any doubt about the contents of this material, it is recommended that you should seek the advice of an independent professional. This material and the information it contains are strictly confidential, the property of SMDAM(HK), and are intended exclusively for the intended recipients. The written consent of SMDAM(HK) is required before it can be replicated or distributed to third parties or used for any other purpose, except as required by law or regulatory requirements. It is not intended for distribution or use by any individual or entity in any jurisdiction or country where such distribution or use would be in violation of local law or regulation. SMDAM(HK) and its affiliated entities accept no liability whatsoever for any consequences, whether direct or indirect that may arise from any third party’s use of information contained in this material. This material is not intended to serve as an invitation, offer, solicitation or recommendation for any investment strategy or the purchase or sale of securities, including shares or units of funds. Any views, analyses, perspectives expressed, and references to companies should not be construed as recommendations or endorsements by SMDAM(HK). All comments, opinions, data and forecasts in this material are based on the information available at the time of drafting, and are subject to change without prior notice in response to market and other conditions. The information provided does not constitute investment advice and should not be relied upon as such. This material may contain certain statements that may be deemed to be forward-looking statements. Please note that any such statements are not guarantees of future performance and actual results or developments may differ significantly from those projected. No assurance can be given that the investment objective of any investment products will be achieved. No representation or promise as to the performance of any investment products or the return on an investment is made. This material does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may access or receive this material. Investment involves risk, including the possible loss of principal amount invested. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets are not indicative of future performance. Any investment decisions made by investors should not be solely based on this marketing material. Investors should refer to the fund’s offering document in order to fully understand the associated risk factors. The value of an investment may go down or up. The final decision in relation to any investment in any stock, companies or markets referred to in this material should be made by you. If investment returns are not denominated in HKD or USD, US/HK dollar-based investors will be exposed to exchange rate fluctuations. The contents of this material are protected by copyright. Without SMDAM(HK)’s prior written consent, copying, reproduction or distribution of its contents in a hard copy and/or through the internet is strictly prohibited. Where the contents of this material have been translated into any language other than English and there is any inconsistency or ambiguity between the English version and the other version, the English version shall prevail. The above policies are subject to review and amendments by us from time to time. |

General Disclaimer:This material is issued by Sumitomo Mitsui DS Asset Management (Hong Kong) Limited (“SMDAM(HK)”) for informational purposes only and has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any other regulatory authority. Persons who access or receive this material should determine whether it is permissible to access or receive it in the relevant jurisdiction without violating any applicable laws and regulations. The material may contain information related to funds which are authorized by the SFC that are available for public sale in Hong Kong. However, SFC authorization is not a recommendation or endorsement of the fund, nor does it guarantee the commercial merits of the fund or its performance. It does not mean the fund is suitable for all investors, nor is it an endorsement of its suitability for any particular investor or class of investors. The information contained in this material has been obtained from sources that are deemed to be reliable and is made available solely for informational purposes. SMDAM(HK) makes no representations or warranties as to the information and does not guarantee its accuracy, timeliness, completeness or usefulness. You are advised to exercise caution in relation to this material, and if you are in any doubt about the contents of this material, it is recommended that you should seek the advice of an independent professional. The written consent of SMDAM(HK) is required before it can be replicated or distributed to third parties or used for any other purpose, except as required by law or regulatory requirements. SMDAM(HK) and its affiliated entities accept no liability whatsoever for any consequences, whether direct or indirect that may arise from any third party’s use of information contained in this material. This material is not intended to serve as an invitation, offer, solicitation or recommendation for any investment strategy or the purchase or sale of securities, including shares or units of funds. Any views, analyses, perspectives expressed, and references to companies should not be construed as recommendations or endorsements by SMDAM(HK). All comments, opinions, data and forecasts in this material are based on the information available at the time of drafting, and are subject to change without prior notice in response to market and other conditions. The information provided does not constitute investment advice and should not be relied upon as such. This material may contain certain statements that may be deemed to be forward-looking statements. Please note that any such statements are not guarantees of future performance and actual results or developments may differ significantly from those projected. No assurance can be given that the investment objective of any investment products will be achieved. No representation or promise as to the performance of any investment products or the return on an investment is made. This material does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may access or receive this material. Investment involves risk, including the possible loss of principal amount invested. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets are not indicative of future performance. Any investment decisions made by investors should not be solely based on this marketing material. Investors should refer to the fund’s Offering Documents, including the Product Key Facts Statement, in order to fully understand the associated risk factors. The value of an investment may go down or up. The final decision in relation to any investment in any stock, companies or markets referred to in this material should be made by you. If investment returns are not denominated in HKD or USD, US/HK dollar-based investors will be exposed to exchange rate fluctuations. The contents of this material are protected by copyright. Without SMDAM(HK)’s prior written consent, copying, reproduction or distribution of its contents in a hard copy and/or through the internet is strictly prohibited. Where the contents of this material have been translated into any language other than English and there is any inconsistency or ambiguity between the English version and the other version, the English version shall prevail. The above policies are subject to review and amendments by us from time to time. IMPORTANT: Please read this disclaimer carefully. By accepting this presentation, you acknowledge that you have read, understood, and agreed to be bound by the terms and conditions set forth herein. |