Insight

In his recent analysis, SMDAM's Chief Global Strategist Hisashi Shiraki, examines the rise in Japanese long-term interest rates and its potential influence on future monetary policies:

“Market participants usually focus on the 10-year government bond as a benchmark. However, it is crucial to note that looking solely at the 10-year bond might be misleading regarding the direction and magnitude of changes in the Japanese bond market.

The Bank of Japan decided to keep its policy rate unchanged at its policy meeting on 19th December 2024, and Governor Ueda made cautious remarks about implementing additional rate hikes, thereby disappointing market expectations. Despite these decisions and comments from the BOJ, Japanese long-term interest rates have risen again, and the 10-year bond yield has reached its highest level in 13 years.

Why did this contradictory reaction occur? The answer lies in the reaction of the foreign exchange market after the BOJ’s decision, where the yen has depreciated significantly—by as much as five yen against the US dollar just after the dovish comments by Governor Ueda. Excessive currency depreciation raises import prices, which in turn pushes up consumer prices, eventually compelling the BOJ to tighten monetary policy further.

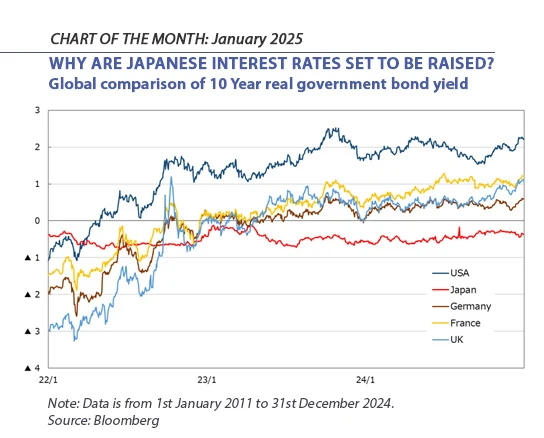

Japan’s Consumer Price Index was up 2.9% year-on-year in November, at a similar level to its global peers, including the US, the UK, and other European countries. Meanwhile, Japan’s policy interest rate remains extremely low at 0.25%, resulting in an ultra-loose monetary policy. Consequently, as shown in the image, Japan’s real interest rates remain extremely low compared to other G7 countries. As Japan’s real interest rate is the only one among major countries that is negative amid ongoing inflation, it is becoming increasingly challenging for the BOJ to maintain such an extremely low interest rate.

As mentioned at the beginning, the 10-year government bond yield of Japan likely remains lower than fundamentals would suggest due to the aftermath of extreme quantitative easing. If we look at the yield of the 5-year government bond, which is less influenced by such policy bias, it is rising more clearly and robustly than the 10-year JGB, having already reached its highest level in 15 and a half years.

Given this context, it appears that Japan’s interest rates will continue to rise in tandem with additional monetary tightening by the BOJ. If the BOJ hesitates to implement further rate hikes in the near future, it is highly possible that it will be forced into more rapid rate hikes in order to deal with rising import prices triggered by yen depreciation. If it’s a matter of time before rate hikes are inevitable, it is preferable to raise rates before further yen depreciation occurs, which would cause less damage to the market and the economy."

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM