Japan boasts some of the world’s best-known and most enduring corporate names. However, for over 3 decades the Japanese equity market has disappointed. Today, years of gradual change is bearing fruit, and we believe new narrative about this ancient country and its long-suffering economy is needed.

Building on the positive momentum of the past few years, early last year the Nikkei 225 index finally surpassed its 1990 peak. Anyone patient enough to have remained invested in Japanese equities for the past 34 years finally broke even, and we argue a new era for the Japanese economy has now opened.

Understanding corporate Japan through a generational lens

A lot can happen in 34 years, for individuals as for economies. Typical usage considers a 30-year period to be a ‘generation’, and so you can locate an entire generation of Japanese individuals who have studied, graduated, entered the workforce, married and started families over the timeframe from the Nikkei’s peak in 1990 to today.

Much has been written about how Japan is now finally emerging from its so-called ‘lost decades’, a period that began with the dramatic deflation of the asset bubble that inflated in the late 1980s. While we’re eager to share optimism over what the future opportunity for Japan looks like, it’s first worth understanding some of the demographic shifts taking place during this period and how they will interact with this rebirth of the Japanese economy.

What is changing inside Japanese boardrooms?

Let’s start by looking inside the typical Japanese boardroom. This is a world where the average CEO today is just over 60. The corporate leaders of this generation were born in the early 1960s; they witnessed the extraordinary reconstruction and subsequent economic growth miracle of Japan after WWII and entered the workforce just as the stock market began its tremendous rise.

The stock market boom ushered in years of rising consumption. When it burst, incomes and asset prices collapsed, leaving Japan with a stagnant economy defined by demand deficit and oversupply. Crucially, contrary to the familiar cycles of ‘boom and bust’, this pattern once established proved exponentially harder to shift out of than anyone anticipated at the time. There are many theories as to what exactly caused or prolonged Japan’s deflation, but we argue it is best characterised by a combination of:

• Toxic debt in banking system which took years to clear and

constrained lending and private sector activity;

• Lack of swift, co-ordinated expansionary fiscal and

monetary policies; and

• The strong yen, which reduced inflationary pressure by

keeping import prices low.

This created a relatively unique social and economic landscape within which an entire generation was formed, and it is this generation who swell the ranks of Japanese corporate leadership today. Specific financial behaviours prevalent in Japanese corporate culture, such as prioritising debt reduction rather than borrowing to invest, and stockpiling cash to provide a buffer against uncertainty, became deeply engrained over these decades. Whilst the balance sheet strength that resulted from this was desirable, the cost of excessive financial conservatism was anaemic growth.

New leaders, new ideas

Today, this generation of managers is approaching retirement. As they pass the reins to their successors, we are witnessing the revival of a more open, risk-taking mindset. What’s more, with new corporate governance guidance from the Tokyo Stock Exchange encouraging this shift, those taking over are clear that the parameters in which they can operate look quite different today.

Changes in the macroeconomic landscape are reinforcing and augmenting this process: higher inflation; higher wages; greater overheads; and a wider and more competitive environment, both domestically and internationally.

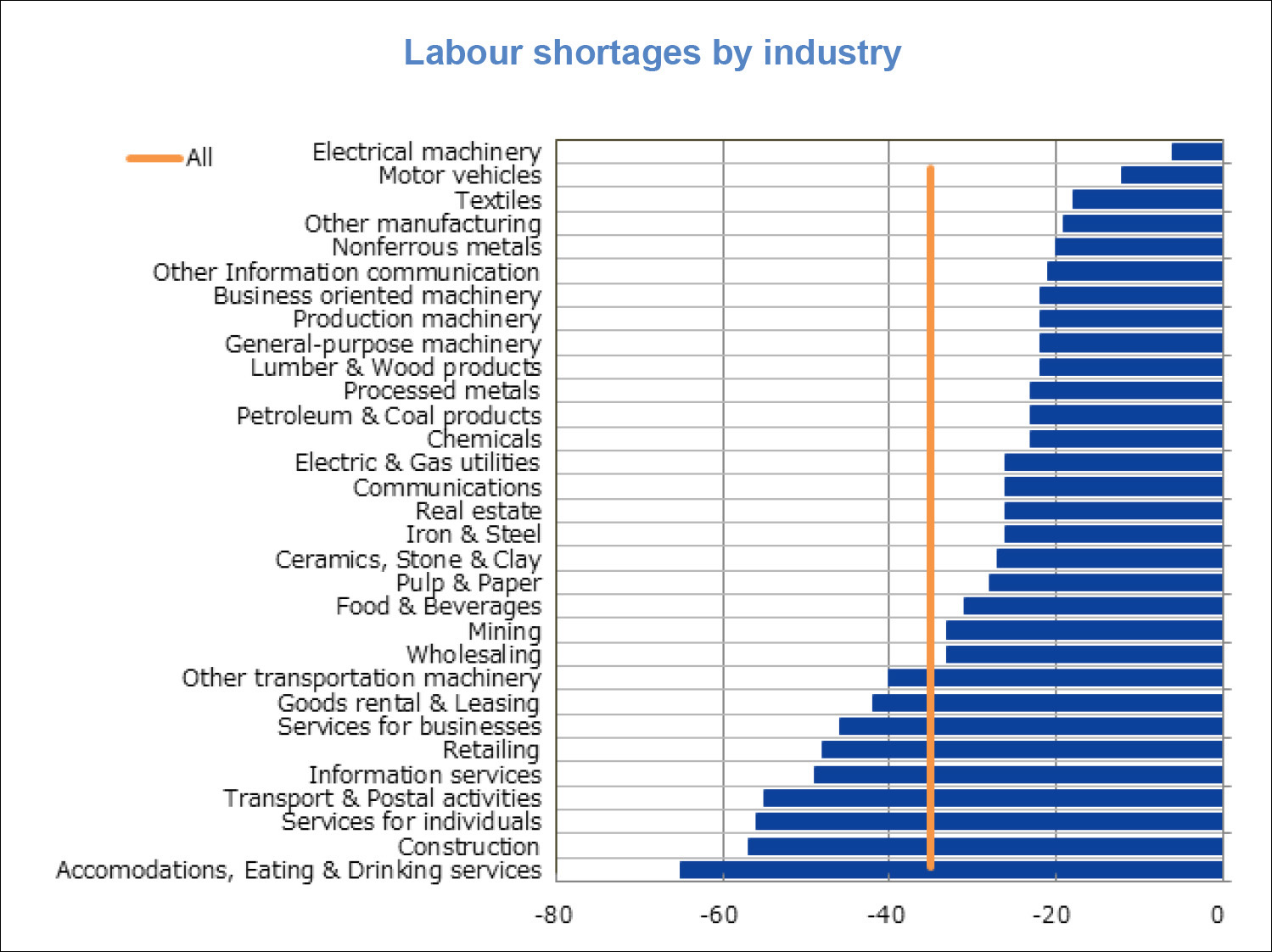

Turning the page on the previous era, the story is becoming one of growth again, with Japanese equities having been on an upwards trajectory since 2012. The labour market is now tighter in several areas – notably construction, manufacturing, and the service sector as shown in the chart below– which increases the likelihood of a clean break from deflation and a positive cycle of rising prices and wages.

Corporate Japan today is being assessed on earnings per share rather than balance sheet alone, with relative profitability is once again driving equity valuations.

Add to this the continued focus on improving governance and the more prominent voice of shareholders today and the result has been a surge of momentum many Japanese CEOs have successfully harnessed. The governance regime has evolved to one that is more transparent and more accountable, with corporate Japan now extending a far more open invitation to join its ranks.

What’s next?

One emerging feature is the move from salaries purely linked to seniority and tenure within the company to now being driven by meritocracy and market worth. Japan’s strength in STEM-related industries means graduates in these subjects are in high demand and could quickly be earning more than older colleagues. This runs contrary to long-held cultural expectations

and could become a source of tension but does fundamentally align Japan’s labour market with other developed market competitors.

The younger generation today are seeing their wages growing faster than the same cohort did 10 and 20 years ago, a tendency that will lead to a positive multiplier effect on aggregate demand.

With younger consumers today working for more lean and entrepreneurial companies, and earning better wages in the process, there are clear signals that Japan’s stagnation is becoming a topic for the history books.

Today, corporate Japan stands well-placed to deliver strong earnings growth due to the dovetailing of the positive trends outlined above. It’s been a long time in the coming, but the direction of travel from here on is clear, and we believe Japan can take heart that the growth-sapping disease of deflation has at last been conquered. To return to the image conjured up by our opening title, the Japan vintage of 2025 promises a much fuller flavour than those of the barren 1990s.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM