Outlook on the Japanese equity market

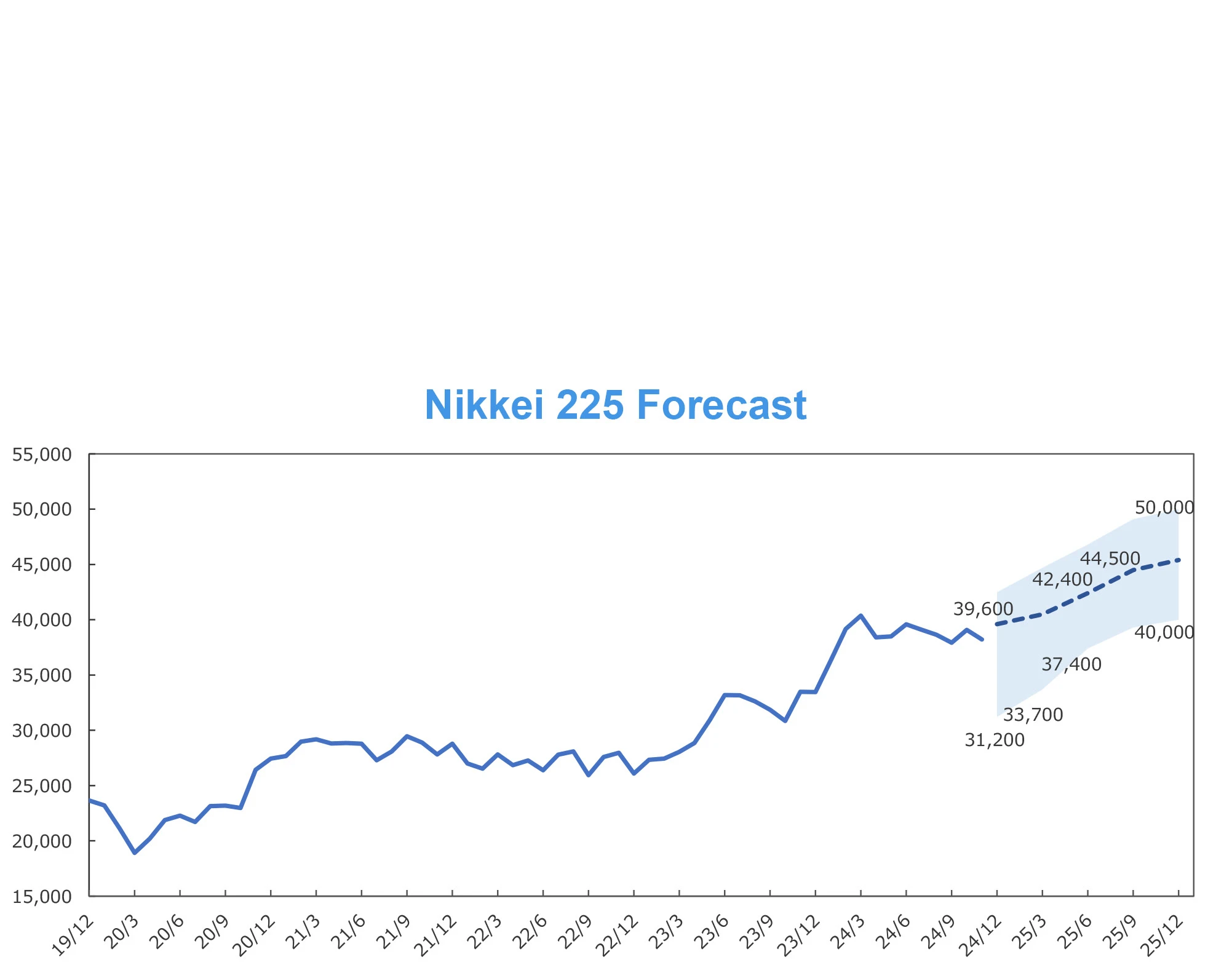

- We estimate the Nikkei 225 will surpass the 40,000 mark again in the near future and reach 45,000 by the end of CY 2025. *

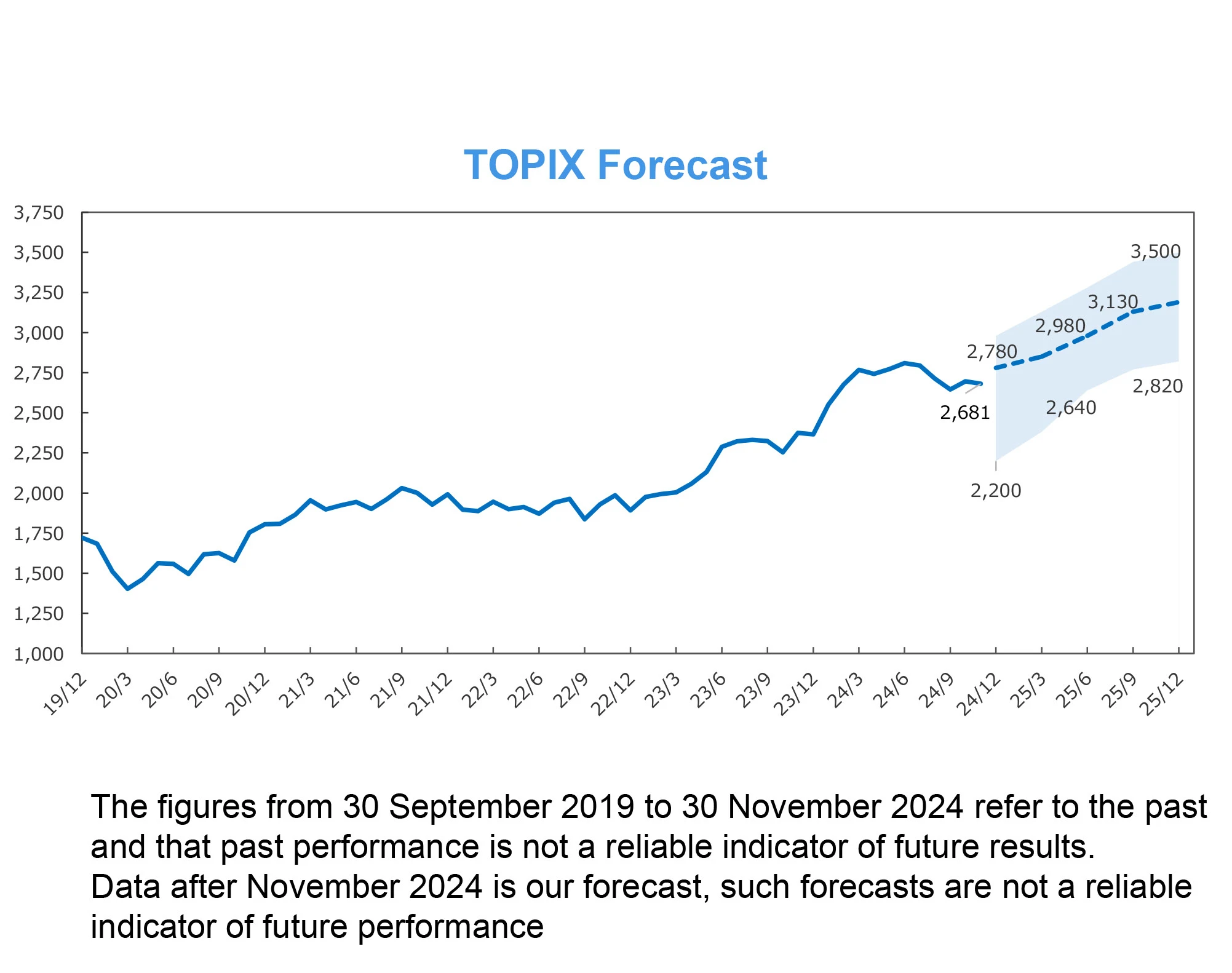

- With the steady growth of corporate earnings, the virtuous cycle of “wage increase and mild inflation”, and continual improvements in corporate governance, we remain bullish on the Japanese stock market across the long term.

- Although foreign investors’ appetite for Japanese stocks appears to be sluggish, a very large amount of share buybacks in the corporate sector could support the stock market going forward.

- We expect the recent range trading to continue in the short term until US monetary policy becomes clearer and market volatility settles

Upside risks

- Increase in terminal rate of economic growth due to the end of deflation

- Further improvements of corporate governance, led by Tokyo Stock Exchange

Downside risks

- Tighter fiscal policy aimed at achieving a primary surplus

- Excessive and rapid appreciation of the JPY, impacting corporate earnings

- Growing political uncertainty

Limited negative impact from overseas

In Q3 2024, real GDP grew for the second consecutive quarter, driven by an increase in consumer spending supported by wage increases and flat-rate tax cuts. This resilience was in spite of a major typhoon and significant earthquake. We expect the decline in capital expenditures (CAPEX), linked to weak capital goods and aggregate supply, to be temporary, as production plans for capital goods remain strong. In terms of external demand, higher goods exports have offset declining service exports.

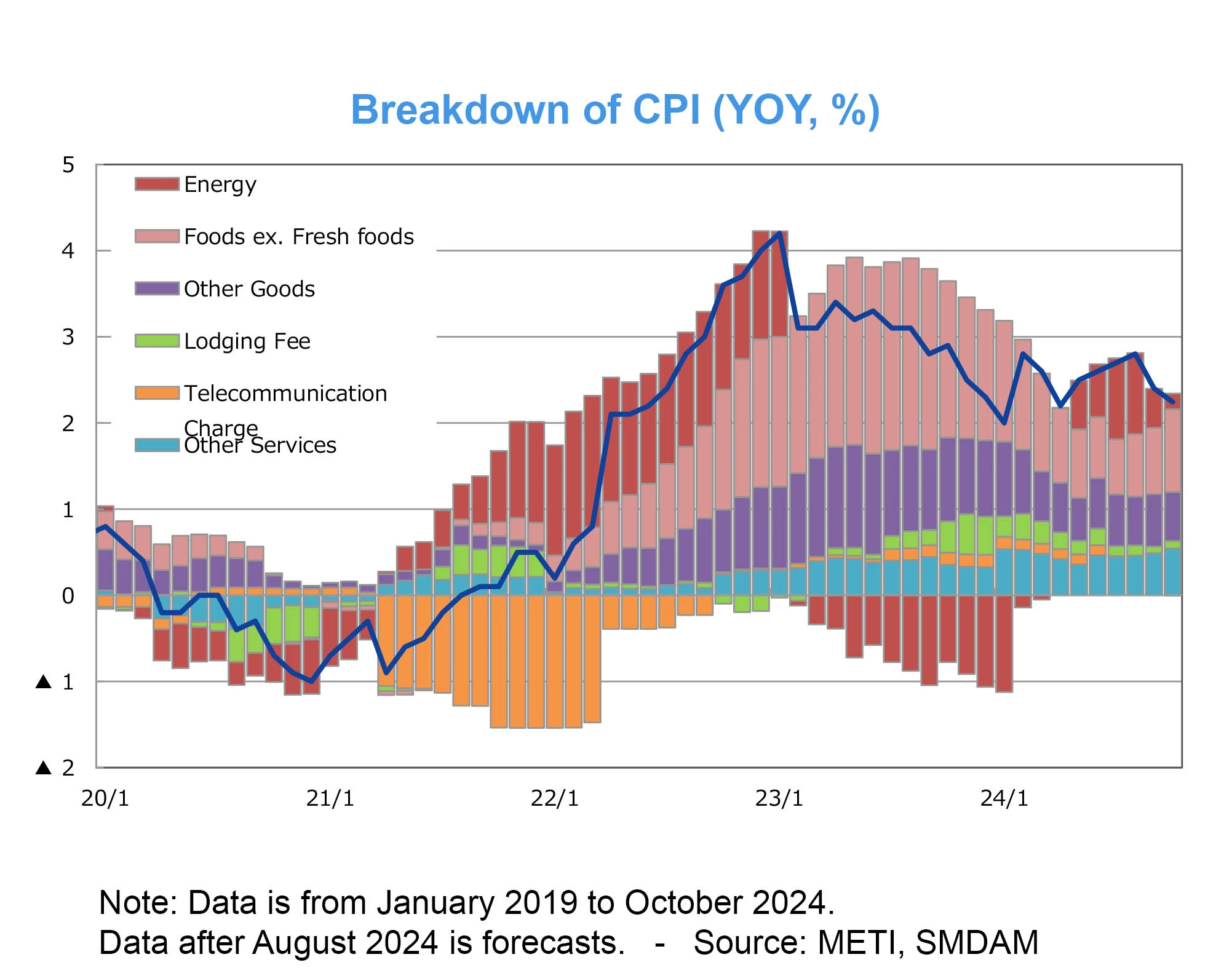

Nationwide core CPI rose by 2.3% year-on-year in October, slightly down from 2.4% in September. Similarly, Tokyo’s core CPI increased by 1.8% year-on-year in October, compared to 2.0% in September. Nationwide CPI growth has eased due to lower electricity and gas prices, supported by government subsidies. In Tokyo, while reduced utility subsidies weighed on inflation, rising food prices exerted upward pressure.

Improved growth outlook for 2025

While we have lowered our real GDP growth forecast for FY 2024 from +0.4% to +0.3%, we have raised our estimate for FY 2025 from +1.0% to +1.2%. We also expect the Japanese economy to grow by +0.8% in FY 2026 in real terms. The downward revision for FY 2024 is mainly due to the decline of real GDP growth in Q3 2024. The upward revision for FY 2025 reflects tax reductions from the review of the basic income deduction, an improved U.S. economic outlook, and increased base effects. This scenario assumes the ruling party will approve half the amount of the revised basic income deduction requested by the Democratic Party for the People. We expect the Japanese economy to return to a moderate growth path, supported by wage increases and CAPEX initiatives like laboursaving measures, digitalization, greening, urban development, and semiconductor factory construction, along with resilient overseas economies.

We have raised our core CPI forecast for FY 2024 from +2.5% to +2.6%, and for FY 2025 from +1.8% to +2.1%. We expect core CPI to remain stable at +2.0% in FY 2026. The upward revisions for FY 2024 and 2025 reflect the unexpected increase in Tokyo Metropolitan Area core CPI, changes in currency forecasts, and adjustments to expected subsidies for electricity and gas prices. Specifically, the assumed subsidized period for FY 2025 has been shortened from nine months (January to September) to three months (January to March). Rising service prices, fuelled by wage increases, will likely sustain inflation, even as cost-push pressures from import prices ease. We forecast core CPI to remain around +2.0% year-on-year, gradually tapering with some fluctuations.

PM Ishiba to maintain policy, but leaner stimulus expected

Prime Minister Ishiba remains committed to combating deflation over the next three years, following the policies of his predecessor. However, fiscal stimulus projections have been revised downward to 20 trillion yen, from the earlier estimate of 25 trillion yen. For FY 2024, the supplementary budget is expected to match FY 2023 levels despite earlier indications of an increase. The Bank of Japan (BoJ) is projected to carefully pace its policy rate hikes, starting with an increase to 0.50% in January 2025, followed by incremental rises to 0.75% in July 2025, 1.00% in January 2026, and 1.25% in January 2027.

After comprehensive research on inflation, domestic conditions, and global trends—particularly looking to the U.S. Outlook Report in January 2025—the BoJ plans to coordinate closely with the government. While risks of currency depreciation might prompt earlier action, gradual rate hikes are expected every six months, towards 1.0% which is the lower end of the neutral interest rate range (1.0-2.5%). Beyond which further rate hikes are only expected at yearly intervals.

If you would like to access the full report please contact your business development representative.

*Calculated by multiplying current and next fiscal year’s estimated EPS by 12 month forward price to earnings ratio. These forecasts represent our house view based on bottom up and top down analysis, rather than a simulation of past performance of the equity market.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Source: SMDAM